The cryptocurrency market, known for its volatility and rapid fluctuations, has recently shown signs that suggest it may be entering a bearish phase. This has led many investors and enthusiasts to speculate about the future of digital assets. But what are the key indicators pointing toward this trend, and what could it mean for the market as a whole?

Key Indicators of a Bearish Market

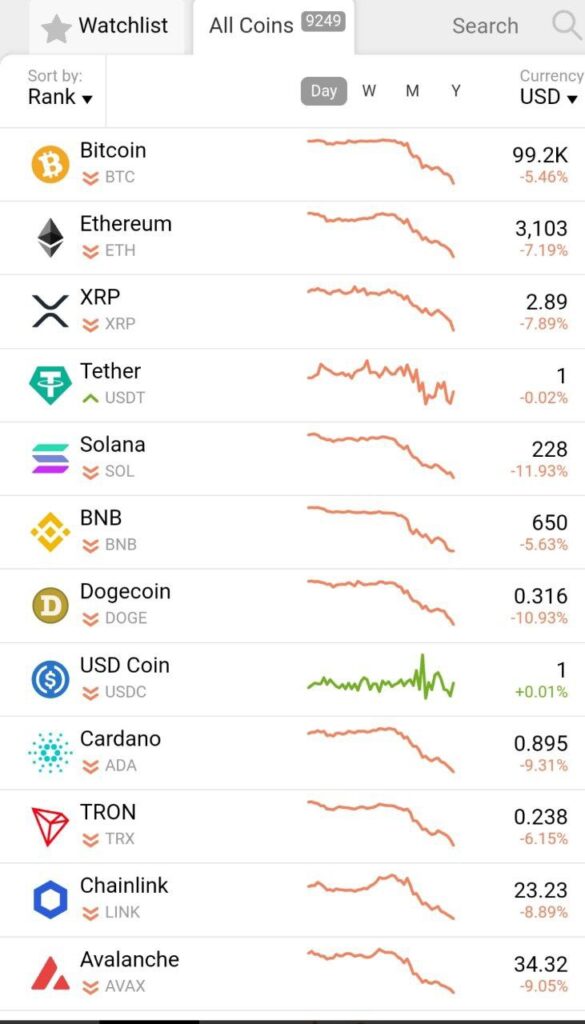

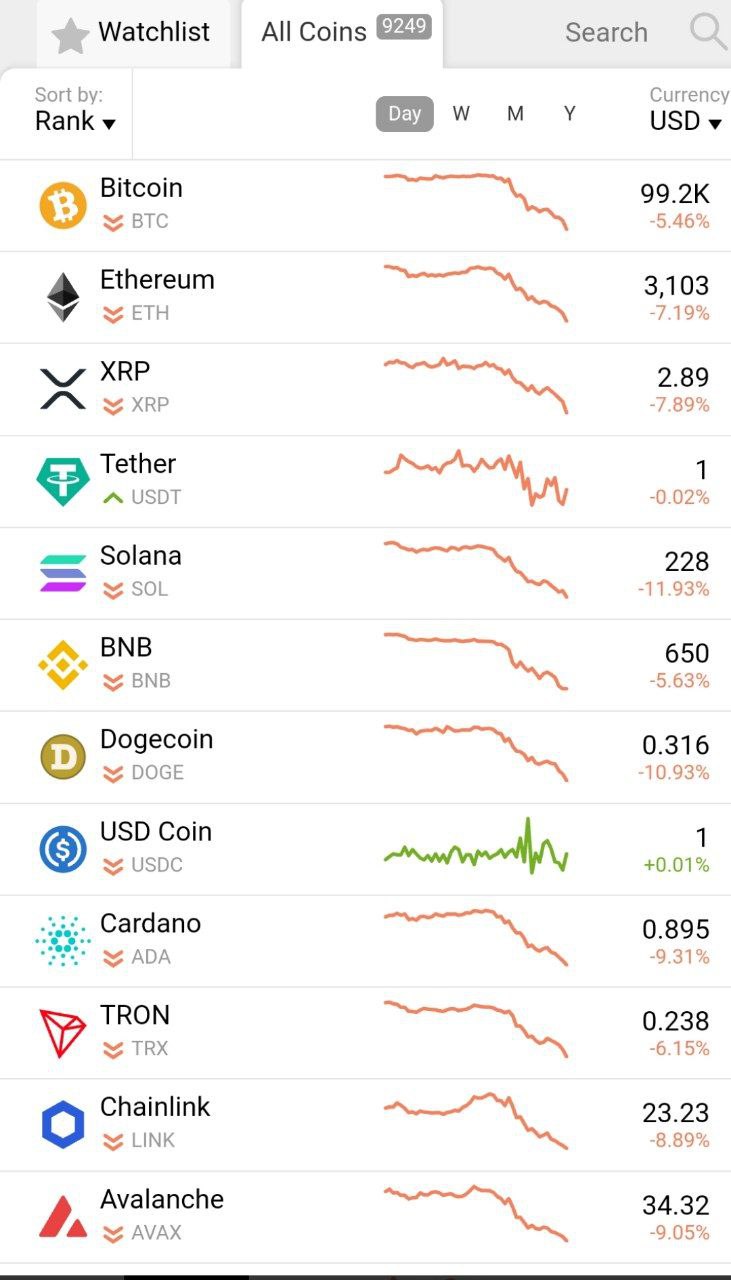

- Decline in Trading Volume A significant drop in trading volume across major cryptocurrencies like Bitcoin and Ethereum often signals waning investor interest. Lower trading activity can reflect reduced market confidence, paving the way for bearish momentum.

- Price Corrections After months of bullish activity, the market tends to undergo corrections. These are often triggered by overbought conditions or macroeconomic factors. Recently, Bitcoin has struggled to maintain key support levels, and similar trends are seen with other leading altcoins.

- Regulatory Pressures Governments worldwide are tightening regulations around cryptocurrencies. For instance, the U.S. SEC’s scrutiny of crypto exchanges and ongoing debates about Central Bank Digital Currencies (CBDCs) have created uncertainty. This regulatory ambiguity often discourages new investments, leading to downward pressure on prices.

- Macro-Economic Trends Broader economic conditions, including interest rate hikes by central banks, inflation fears, and global geopolitical tensions, play a significant role in investor behavior. With riskier assets like cryptocurrencies, such external factors can accelerate a market downturn.

What This Means for Investors

While the signs of a bearish market are concerning, they also present opportunities. Experienced investors often see market downturns as chances to buy at lower prices.

However, for less seasoned participants, it’s crucial to:

- Diversify: Avoid putting all your capital into cryptocurrencies.

- Research: Focus on projects with strong fundamentals that can withstand prolonged bearish conditions.

- Practice Patience: Markets move in cycles, and bearish phases are often followed by recovery and growth.

Could This Be Temporary?

Cryptocurrency markets have historically demonstrated resilience. The current bearish indicators could be temporary, depending on the resolution of macroeconomic challenges and market sentiment. Institutional interest in blockchain technology and long-term adoption trends suggest that the market’s foundation remains robust.

Final Thoughts

Whether the crypto market is headed into a prolonged bearish phase or a short-term correction, the key for investors is to stay informed and adapt their strategies accordingly. As the saying goes in the crypto world: “Zoom out.” Understanding the bigger picture can help navigate these uncertain times effectively.

Leave a Comment