Ethereum (ETH) has long held the second-largest market capitalization in the cryptocurrency space, standing behind Bitcoin (BTC). However, a contrarian theory suggests that ETH will experience a major price surge only after it loses its #2 position. While this may sound counterintuitive, there are several reasons why a drop in ranking could serve as a catalyst for Ethereum’s next big rally.

The Complacency of the #2 Spot

For years, ETH’s status as the second-largest crypto has been both a blessing and a curse. While it has enjoyed high liquidity, institutional adoption, and a strong developer community, its dominance has also led to complacency among investors. The assumption that ETH will always be #2 creates a lack of urgency for investors to buy in at lower prices. If Ethereum were to slip to third or fourth place, it could shake market sentiment and force a reevaluation of ETH’s true potential, spurring renewed investment interest.

A Wake-Up Call for Ethereum Developers

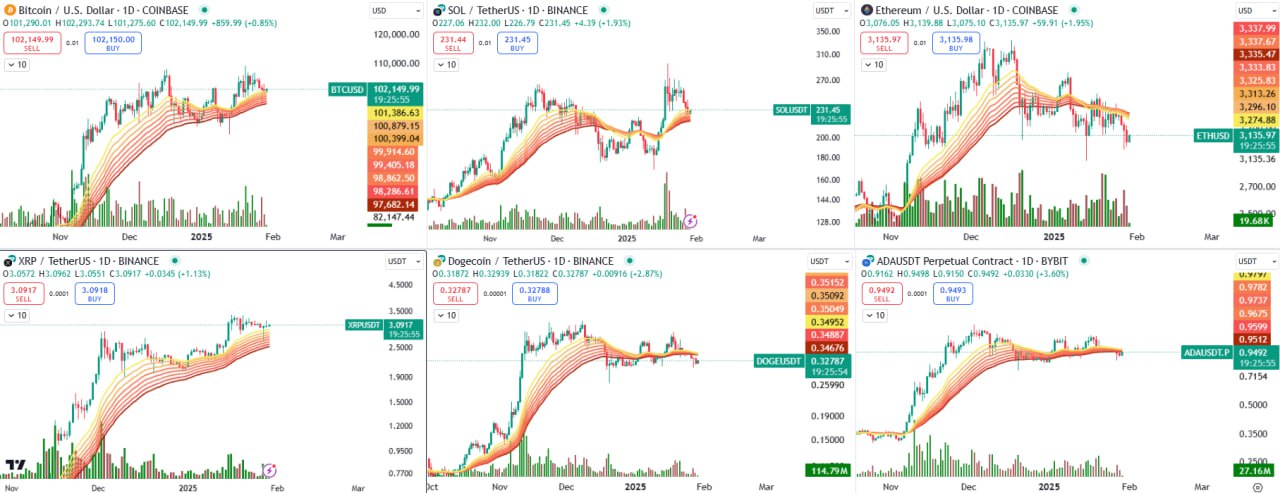

Losing its rank could serve as a wake-up call for Ethereum’s core developers and community. As competitors like Solana (SOL), Binance Smart Chain (BSC), and emerging layer-1 solutions gain ground, Ethereum’s team may feel an increased sense of urgency to accelerate development, optimize gas fees, and improve network scalability. This renewed push for innovation could re-establish Ethereum’s dominance and drive a major price rebound.

A Shift in Narrative

The crypto market is driven by narratives, and Ethereum losing its #2 spot would create a powerful new one: “The Underdog’s Comeback.” Traders and investors are always looking for assets with a strong rebound story. If ETH were to drop in rank, the narrative would shift to Ethereum being undervalued and primed for a comeback—leading to a surge in speculative buying and long-term accumulation.

Flushing Out Weak Hands

Many ETH holders are long-term believers, but a portion of its investor base consists of weak hands who are easily shaken by negative price action. A loss in rank could cause panic selling, creating an opportunity for strong hands to accumulate ETH at a discount. Once the selling pressure subsides, ETH could experience a strong recovery as confidence is restored.

Historical Precedents in Crypto

History has shown that assets often experience massive rallies after a period of relative weakness. Bitcoin itself faced skepticism after multiple price crashes but always rebounded to new highs. Similarly, if Ethereum were to momentarily fall out of the #2 position, it could set the stage for a dramatic resurgence, potentially even challenging Bitcoin’s dominance in the long run.

Conclusion

While most ETH investors would prefer to see Ethereum maintain its position as the second-largest cryptocurrency, a shake-up in market rankings might actually be the catalyst needed for its next big rally. A loss in rank could trigger renewed developer efforts, shift investor sentiment, and create a strong comeback narrative. Ironically, Ethereum might only reach its true potential after experiencing a temporary fall from grace.

Leave a Comment