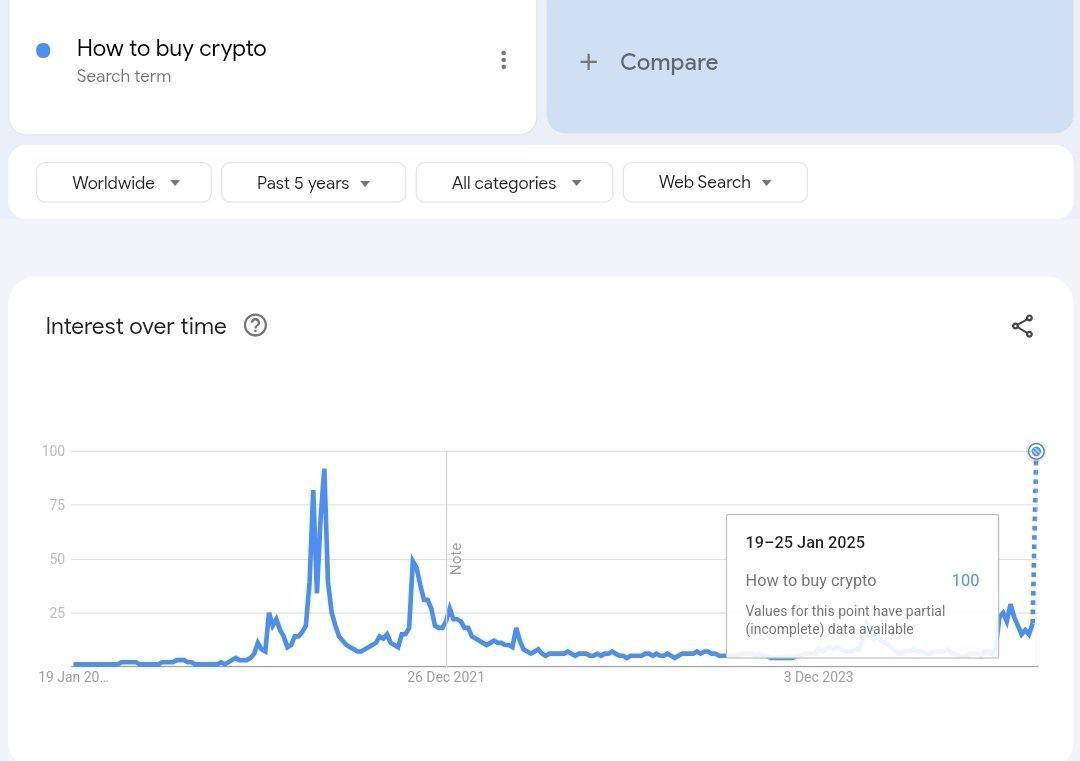

In a remarkable shift of public interest, the search term “How to buy crypto” has hit a 4-year high on Google Trends. This surge in curiosity is reminiscent of the euphoric days of the 2017-2018 crypto bull run. But what exactly is fueling the renewed enthusiasm in 2025? Let’s explore the potential reasons behind this spike, how it could affect the market, and what new investors need to know.

The Trump Inauguration: A Bullish Catalyst?

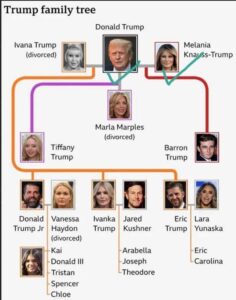

Significant political events often influence financial markets, and the 2025 inauguration of former President Donald Trump may be no exception. Political rhetoric around monetary policy, deregulation, and fiscal reforms can shift investor sentiment. Trump’s administration has previously been associated with market volatility, and his return to office has reignited discussions on economic policy.

Some analysts argue that his stance on reducing the influence of central banks and promoting deregulated financial markets might indirectly benefit cryptocurrencies. Historically, political shifts and uncertainty have prompted investors to seek refuge in alternative assets like Bitcoin and Ethereum, which are seen as hedges against inflation and currency devaluation.

Factors Behind the Surge in Interest

- Economic Instability and Rising Inflation:

- Inflation remains a global concern. As central banks struggle to tame rising prices, more individuals turn to cryptocurrencies as a potential store of value and an alternative to fiat currency.

- Institutional Adoption and Mainstream Acceptance:

- Major financial firms, including BlackRock and Fidelity, have expanded their crypto offerings, lending further legitimacy to digital assets. Exchange-traded funds (ETFs) for Bitcoin and other cryptocurrencies are gaining traction, making investment easier for the average consumer.

- Technological Advancements and DeFi Growth:

- Decentralized finance (DeFi) platforms, NFTs, and the rise of Layer 2 scaling solutions are transforming the blockchain ecosystem. Innovations like Ethereum 2.0, which improves scalability and reduces fees, attract new participants.

- The Bitcoin Halving Cycle:

- Bitcoin’s next halving, expected in 2024-2025, historically precedes significant price increases. This cyclical event reduces the mining reward by half, tightening supply and often triggering bullish market behavior.

Step-by-Step Guide: How to Buy Crypto in 2025

If you’re new to the crypto space, here’s a practical guide to get started:

- Choose a Secure and Reputable Exchange:

- Popular exchanges include Coinbase, Binance, Kraken, and Gemini. Prioritize platforms with robust security features and user-friendly interfaces.

- Create an Account and Complete Identity Verification:

- Most platforms require government-issued ID and proof of address to comply with regulations and prevent fraud.

- Deposit Funds:

- Fund your account using bank transfers, debit/credit cards, or other payment options. Be aware of transaction fees.

- Research and Select Your Cryptocurrency:

- Beginners often start with Bitcoin or Ethereum. Stablecoins like USDC are also popular for minimizing volatility. Research each asset’s purpose, potential, and risks.

- Make a Purchase:

- Decide whether to buy at market price or set a limit order for a preferred price.

- Transfer to a Secure Wallet:

- For added security, move your holdings from the exchange to a personal crypto wallet. Options include hardware wallets (like Ledger or Trezor) and software wallets (like MetaMask or Trust Wallet).

- Stay Updated and Practice Safe Investing:

- Follow market trends, regulatory changes, and technological advancements. Avoid investing more than you can afford to lose.

Market Implications and the Road Ahead

The surge in searches about buying crypto signals growing public interest and a potential influx of new market participants. Historically, increased retail engagement has both positive and negative effects:

- Positive Impact: More participants can drive demand, increasing prices and liquidity across markets.

- Challenges: Inexperienced investors often fuel volatility and are susceptible to market manipulation and scams.

As blockchain technology matures and more use cases emerge, the broader adoption of cryptocurrencies seems inevitable. However, regulation remains a critical factor. Global authorities continue to craft policies that balance innovation with consumer protection.

Final Thoughts

The renewed curiosity about how to buy crypto highlights a shifting financial landscape. Whether driven by political events, macroeconomic forces, or technological evolution, this resurgence of interest may signal the start of a new market phase. However, volatility remains a hallmark of crypto investments. Newcomers and veterans alike should prioritize education, security, and cautious investment strategies.

Could this be the dawn of another bull run? While no one can predict the future with certainty, the parallels to previous market cycles are striking. Stay vigilant, diversify your portfolio, and never invest without thorough research.

Leave a Comment