In the world of cryptocurrencies, the term Fully Diluted Value (FDV) refers to the estimated total market value of a crypto asset if all tokens that can be issued were in circulation. This metric provides a more complete picture of the potential market capitalization of a project, considering the maximum number of tokens that can be produced. FDV is important for investors looking to assess the risks and potential long-term gains of a crypto project. Below, we will discuss some crypto projects that have recently listed in the last month and how their FDVs can provide insights into their future prospects.

What is Fully Diluted Value (FDV)?

In simple terms, FDV is calculated by multiplying the current price per token by the total maximum number of tokens that can be issued by a project. For example, if a project has a maximum supply of 1 million tokens and the current price per token is $10, then the FDV of the project would be $10 million. This metric provides an understanding of the potential market value of a token if the entire supply of tokens were in circulation. FDV is a valuable evaluation tool for investors as it helps them see whether the current token price reflects the potential total supply that will be released.

Why is FDV Important for Investors?

FDV becomes a crucial analysis tool because it offers insights into the risks that may arise in the future, especially concerning tokens that are yet to be circulated. If FDV is much higher than the current market capitalization, it could indicate potential selling pressure when the tokens that haven’t yet been released enter the market. Conversely, if the current market capitalization is close to the FDV, the market may have already priced in the entire token supply that will eventually be released.

For investors, understanding FDV helps to identify projects with higher growth potential or those that may face selling pressure due to the additional token supply still to come.

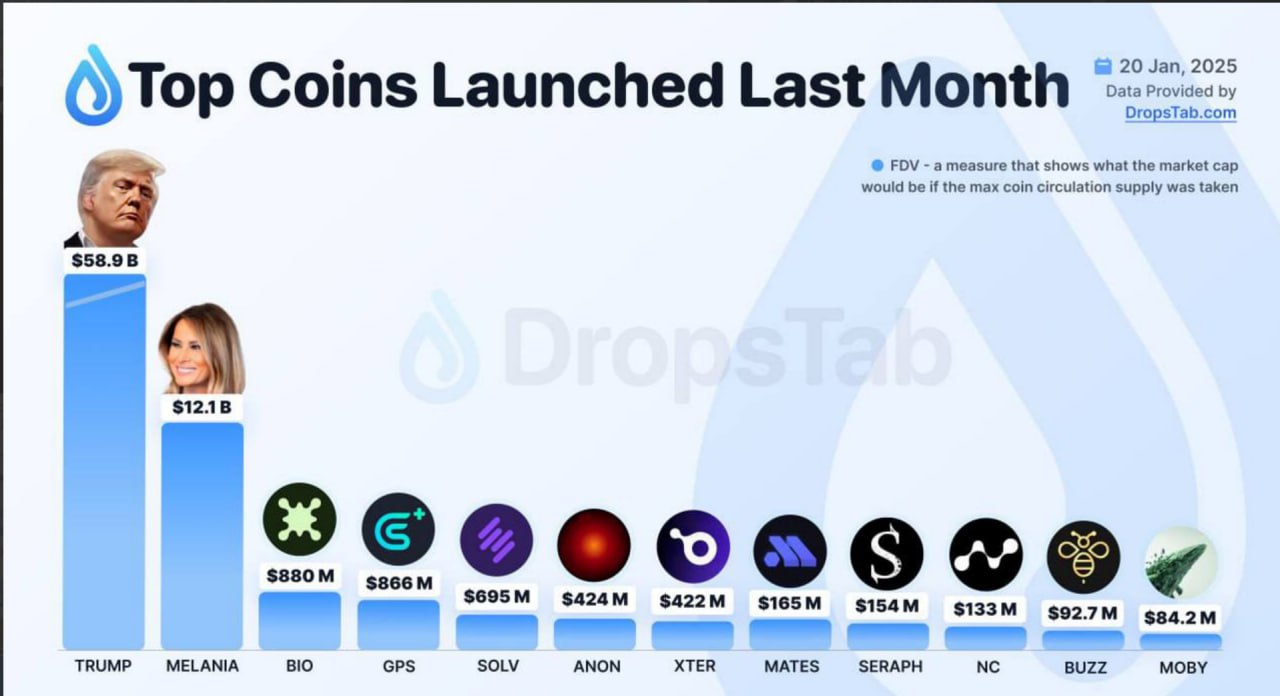

Top Coins Listed in the Last 1 Month Based on FDV

Here are some crypto projects that have recently listed in the last month, ranked by their FDVs. It’s important to note that FDV figures can change with fluctuations in token prices and the release of new tokens.

- Project A

- FDV: $500 million

- Maximum Token Supply: 10 million

- Current Token Price: $50

- Description: Project A is a decentralized finance (DeFi) platform aiming to offer low-cost lending and staking solutions. With a high FDV, investors need to monitor the potential impact of additional token supply that could affect the price in the future.

- Coin B

- FDV: $300 million

- Maximum Token Supply: 30 million

- Current Token Price: $10

- Description: Coin B recently launched its mainnet and focuses on the NFT sector. Its current market capitalization is still much lower than its FDV, showing significant growth potential, but also considerable risks due to the undistributed token supply.

- Token C

- FDV: $800 million

- Maximum Token Supply: 100 million

- Current Token Price: $8

- Description: Token C focuses on blockchain scalability and solutions for fast and low-cost transactions. Despite its high FDV, the current token price suggests growth potential.

- DApp D

- FDV: $1.2 billion

- Maximum Token Supply: 50 million

- Current Token Price: $24

- Description: DApp D is a decentralized application integrating blockchain technology with the e-commerce ecosystem. With a high FDV, this project has substantial growth capacity, but investors should be cautious of potential selling pressure from undistributed tokens.

- Coin E

- FDV: $150 million

- Maximum Token Supply: 15 million

- Current Token Price: $10

- Description: Coin E is a project focused on cross-border payment solutions using blockchain technology. With a relatively lower FDV compared to other projects, Coin E might offer opportunities with lower risks related to token supply.

Conclusion

Understanding FDV is crucial for investors in evaluating the potential and risks of cryptocurrency investments. By knowing the FDV of a project, investors can assess how the undistributed token supply may affect market prices in the future. While FDV provides a clearer picture of a token’s potential market capitalization, investors should remain cautious and consider other factors such as user adoption, technological developments, and overall market dynamics.

For those looking to invest in new crypto assets, it is always essential to conduct thorough research and fully understand the project dynamics and the implications of FDV before making an investment decision.

Leave a Comment