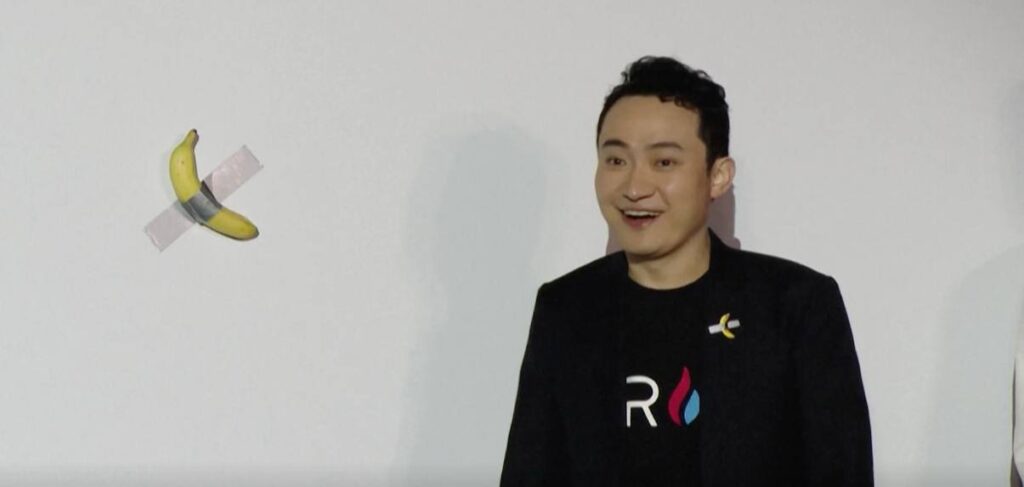

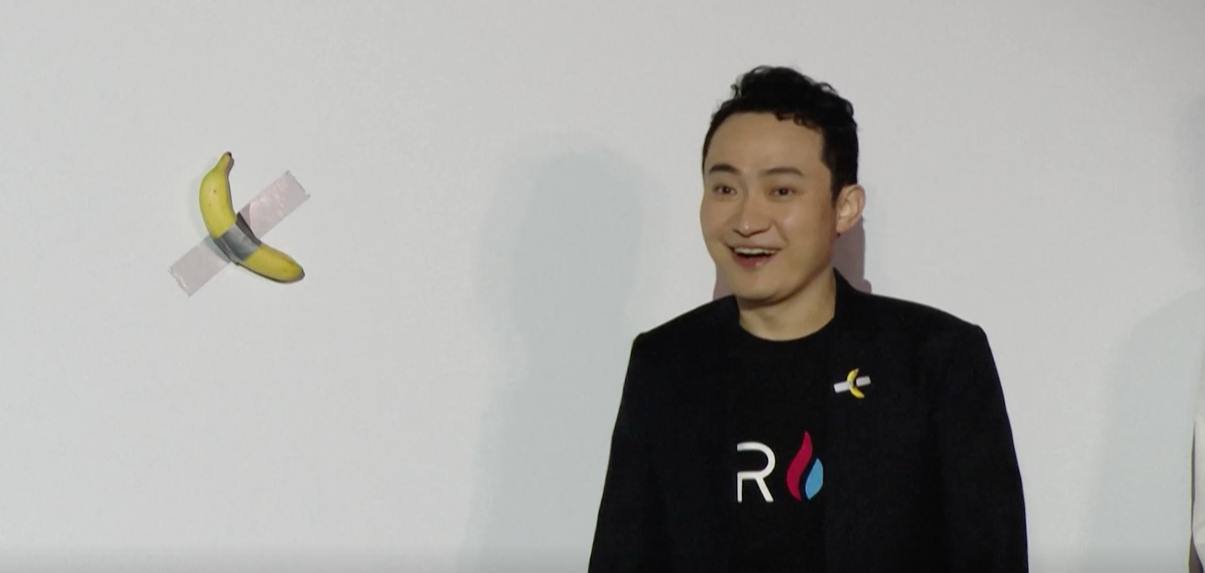

Justin Sun Unveils the Next Generation of USDD

Justin Sun, the founder of TRON, has officially launched USDD 2.0, a revamped version of the TRON-based decentralized stablecoin. Alongside the announcement comes the promise of a strikingly high annual yield of 20%, making waves in the world of decentralized finance (DeFi). According to TRON DAO, this yield will be fully funded by the organization’s resources, raising both excitement and skepticism in the crypto community.

The Appeal of USDD 2.0

The promise of a 20% yield on holdings is designed to attract significant investor interest. In a competitive DeFi market where stablecoin yield opportunities have diminished since their peak in 2021, such returns could position USDD 2.0 as a lucrative option for yield seekers. Here are some key features and differentiators of USDD 2.0:

- Enhanced Stability Mechanisms: USDD 2.0 will implement an improved arbitrage model and dynamic interest rate adjustments to better maintain its peg to the US dollar.

- Decentralized Reserves: Unlike some centralized stablecoins, TRON DAO’s decentralized reserves will provide over-collateralization, ensuring a safety buffer.

- Improved Yield Distribution: The 20% annual yield will be managed through a more transparent, algorithmic structure, aiming for predictable and sustainable returns.

- Real-Time Monitoring Tools: TRON will offer tools for users to track collateral ratios and reserve holdings in real time, enhancing transparency and trust.

Is It Really Safe?

While the 20% yield promise is tantalizing, many crypto veterans are wary of potential risks. Key considerations include:

- Sustainability of Yield Funding a 20% yield entirely from TRON DAO’s resources raises questions about long-term viability. High yields in DeFi have historically been linked to elevated risk. For example, Terra’s UST collapse in 2022 demonstrated how unsustainable returns can lead to systemic failure. TRON DAO claims its diversified revenue streams from ecosystem activities and partnerships will support the yield. However, the durability of this model in a bear market remains uncertain.

- Reserve Transparency and Risk Mitigation TRON has emphasized decentralized reserves to back USDD 2.0. These reserves reportedly include a mix of highly liquid assets like BTC, USDT, and TRX. However, questions about the reserve’s exact composition, auditing frequency, and third-party verification need clear answers. Without transparent audits, confidence in the peg stability could be undermined.

- Regulatory Scrutiny Stablecoins are under increasing global regulatory pressure, with governments seeking stricter oversight to mitigate financial stability risks. USDD 2.0’s structure, particularly its algorithmic components and high-yield model, may invite regulatory scrutiny, similar to the examination of other algorithmic stablecoins.

- Market Volatility USDD 1.0 faced challenges in maintaining its dollar peg during volatile market conditions. Despite the improved stabilization mechanisms, USDD 2.0 must prove its resilience under similar stress. Historical market shocks, liquidity crises, or large-scale redemptions could test its stability.

Comparing USDD 2.0 to Other Stablecoins

- USDT (Tether): The most widely used stablecoin, backed by reserves of cash equivalents, but facing long-standing questions about reserve transparency.

- USDC (USD Coin): Operated by Circle, USDC is fully collateralized with regular audits, offering a more regulated alternative.

- DAI: A decentralized stablecoin managed by the MakerDAO protocol, collateralized with a mix of crypto assets.

USDD 2.0 seeks to combine decentralization with high-yield benefits, positioning it uniquely. However, unlike fully collateralized models such as USDC, the algorithmic stabilization mechanisms introduce greater complexity and potential risk.

The Path Ahead for USDD 2.0

TRON DAO’s aggressive push to gain market share in the stablecoin ecosystem with USDD 2.0 will undoubtedly draw significant attention. If successful, it could elevate TRON as a dominant player in DeFi. To achieve this, the project will need to:

- Maintain transparent and auditable reserves.

- Deliver consistent performance in stabilizing the peg.

- Address regulatory requirements proactively.

For now, USDD 2.0 represents a bold experiment in DeFi economics. Whether it will emerge as a breakthrough innovation or another cautionary tale of unsustainable yields will depend on its execution and market dynamics.

Leave a Comment